The Shanghai stock benchmark retreated from a fresh 10-year high to close lower on Tuesday as investors rotated into undervalued sectors following a blistering rally.

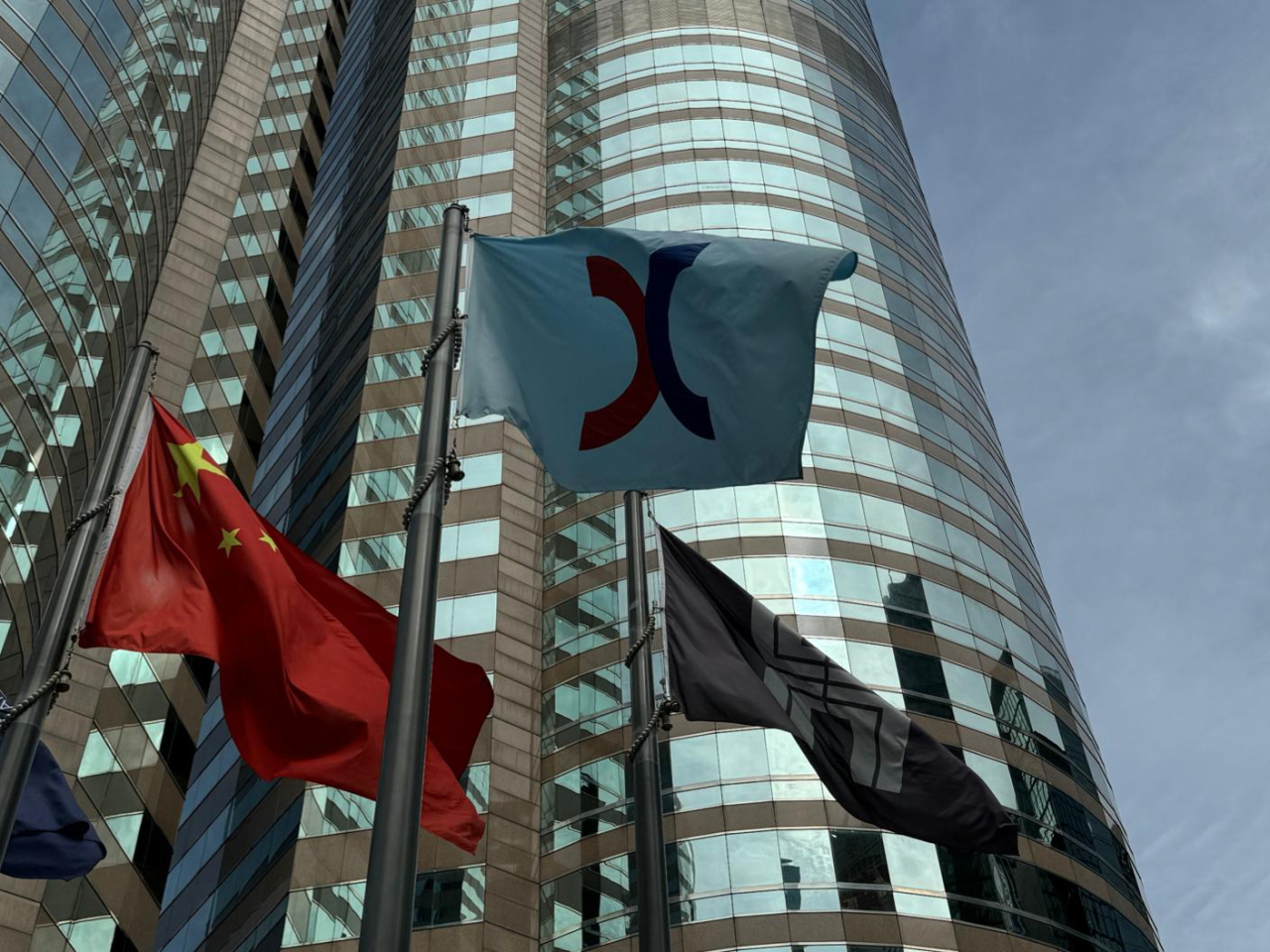

In Hong Kong, the benchmark Hang Seng Index ended down 304 points, or 1.18 percent, at 25,524.

For its part, the Hang Seng China Enterprises Index lost 1.1 percent, with HSBC raising its year-end targets for both indexes, suggesting around seven percent additional upside from current levels.

Up north, the benchmark Shanghai Composite Index closed down 0.39 percent at 3,868 while the Shenzhen Component Index went the other way, up 0.26 percent, at 12,473.

Investor enthusiasm remained strong, with combined turnover on the Shanghai and Shenzhen exchanges coming in at 2.68 trillion yuan, down from 3.14 trillion yuan on Monday, but marking the 10th consecutive session it has gone past two trillion yuan in the longest such streak on record.

Stocks related to pork and video games led the gains while stocks related to contract research organisations and permanent magnetic materials suffered major losses.

The ChiNext Index, tracking China's Nasdaq-style board of growth enterprises, lost 0.76 percent to close at 2,742.

China's blue-chip CSI300 Index declined around 0.4 percent after touching a fresh intraday high since July 2022.

However, technical indicators began showing early signs of exhaustion following a roughly 25 percent rebound in the Shanghai benchmark since its April low.

The relative strength index was at 87.9, well above the 70 mark that many analysts consider indicative of an overheated market.

"After a solid run in Chinese equities, it's only natural to question whether this momentum will continue," said Herald van der Linde, head of equity strategy, Asia Pacific, at HSBC.

Nomura analysts said Chinese equities aren't at "bubble" levels yet, and near-term positive momentum amid strong liquidity flows and stable US-China relations should lift the market.

The real estate sector lost 1.2 percent, paring gains sparked by Shanghai's latest efforts to boost the housing market.

The rare earth sector fell 2.4 percent after US President Donald Trump said China had to give magnets to the United States or face a 200 percent tariff. (Reuters/Xinhua)