Hong Kong stocks hit four-year highs on Tuesday, buoyed by expectations of an imminent US rate cut, but the rally in the mainland took a breather as a tumble in chipmaking giant SMIC soured sentiment.

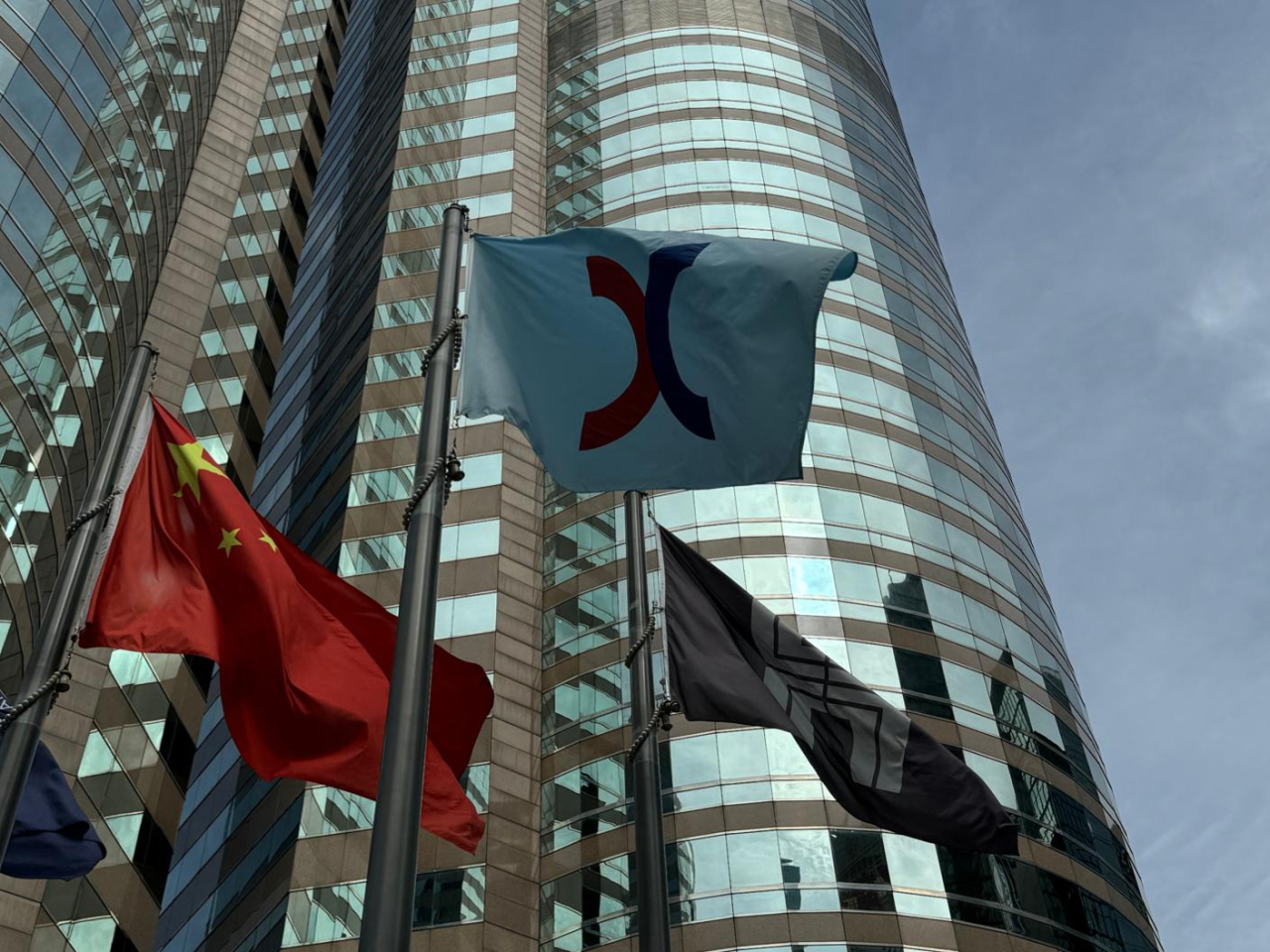

The benchmark Hang Seng Index ended trading for the day up 304 points, or 1.19 percent, at 25,938, its highest closing level since late October 2021.

Property shares surged as some bet the sector is bottoming out.

On the mainland, the benchmark Shanghai Composite Index ended down 0.51 percent to 3,807 while the Shenzhen Component Index closed 1.23 percent lower at 12,510.

Hong Kong shares joined Asian markets higher amid expectations that the Federal Reserve would ease rates when it meets next week, following Friday's dismal US jobs report.

Investors also took cues from Wall Street's positive lead overnight that saw the Nasdaq notch a record-high close.

Guoyuan International said Hong Kong stocks are bolstered by bullish global markets amid bets the Fed will cut rates this month.

In addition, "potential policy easing in China will also prop up Hong Kong's stock valuations".

On the mainland, a slump in Semiconductor Manufacturing International Corp prompted profit-taking in the tech sector.

Shares of China's leading chip foundry dropped 10 percent after the stock resumed trading following announcement of an acquisition deal.

China's tech-focused Star50 Index lost 2.4 percent while indexes tracking Chinese chipmakers also fell sharply.

Bucking the trend, shares of Chinese gold miners jumped as the yellow metal continued to rally. (Reuters/Xinhua)