China stocks fell sharply on Monday as a renewed trade war between Washington and Beijing hit risk appetite and spurred profit-taking in a share market hovering near its highest level in a decade.

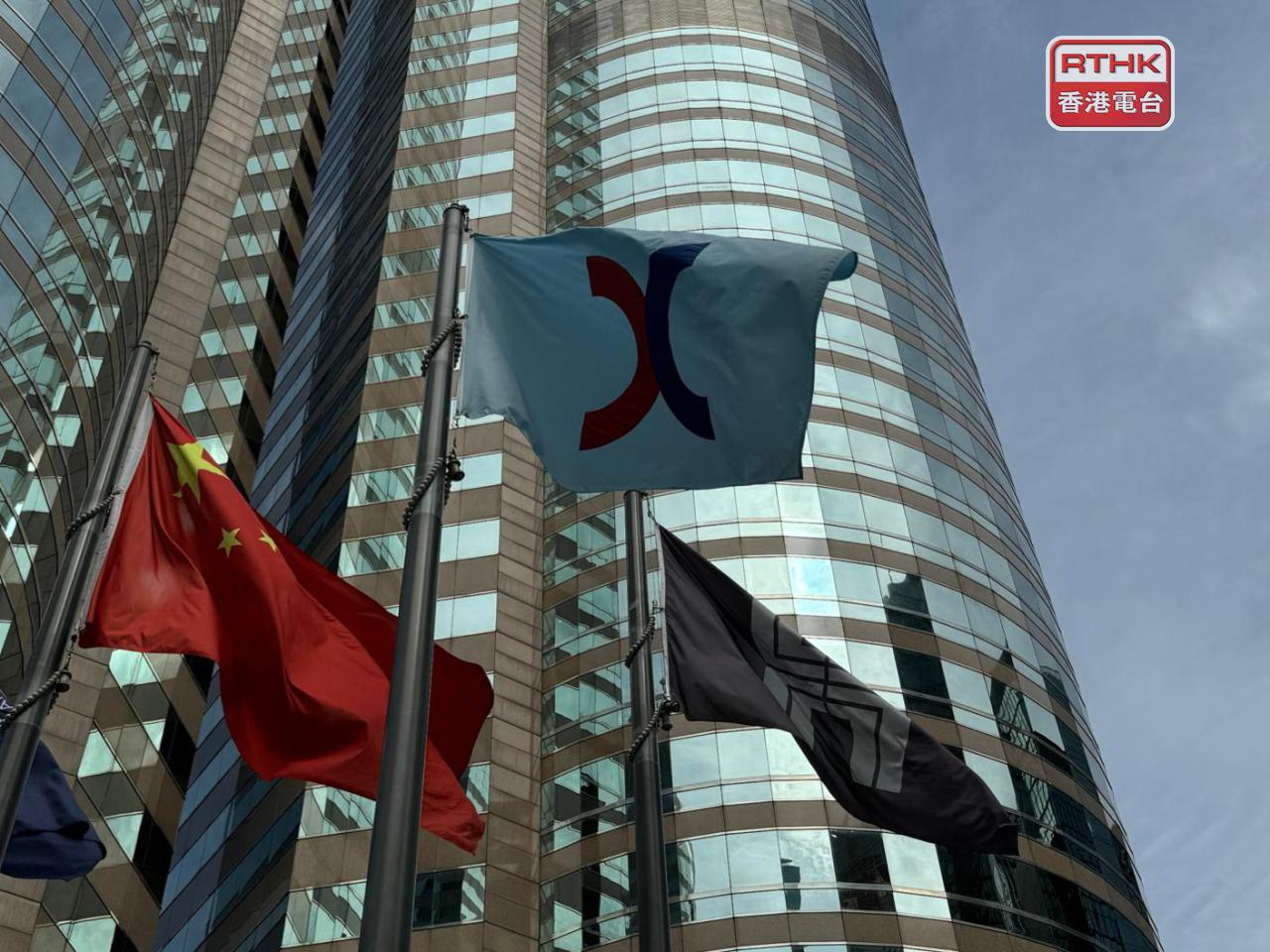

In Hong Kong, the benchmark Hang Seng Index lost 656 points, or 2.5 percent, to open at 25,634.

On the mainland, the benchmark Shanghai Composite Index was down 2.49 percent to open at 3,800 while the Shenzhen Component Index opened 3.88 percent lower at 12,837.

The ChiNext Index, tracking China's Nasdaq-style board of growth enterprises, was down 4.44 percent to open at 2,975.

Defying the broader selloff, China's strategic sectors including rare earths and semiconductors were up in early trade.

However, investors and analysts believe the sell-off will be less severe than the panic-selling seen in April, when US President Donald Trump kicked off a global tariff war. Bond prices are expected to rise on Monday.

Trump on Friday unveiled additional levies of 100 percent on China's US-bound exports, along with new export controls on critical software by November 1, in a reprisal against China curbing its critical rare earth exports.

The threats, made after Asian markets closed, sent US and European markets sharply lower.

An index tracking Nasdaq-listed China stocks tumbled 6 percent, while the US-listed KraneShares CSI China Internet ETF plunged 7 percent.

"In the short term, the revived trade war will weigh on China's stock market," said Wang Yapei, a Shanghai-based hedge fund manager.

But he expects the turbulence to be short-lived, betting China and the US will eventually work through negotiations, as "the cost of large-scale conflict is too high for both powers."

Investors also expect policy support from Beijing to help soothe investor nerves while betting that Trump may back down slightly. (Reuters/Xinhua)