Mainland stocks edged up on Thursday, led by gains in new energy sector shares, while investors awaited key economic data due on Friday.

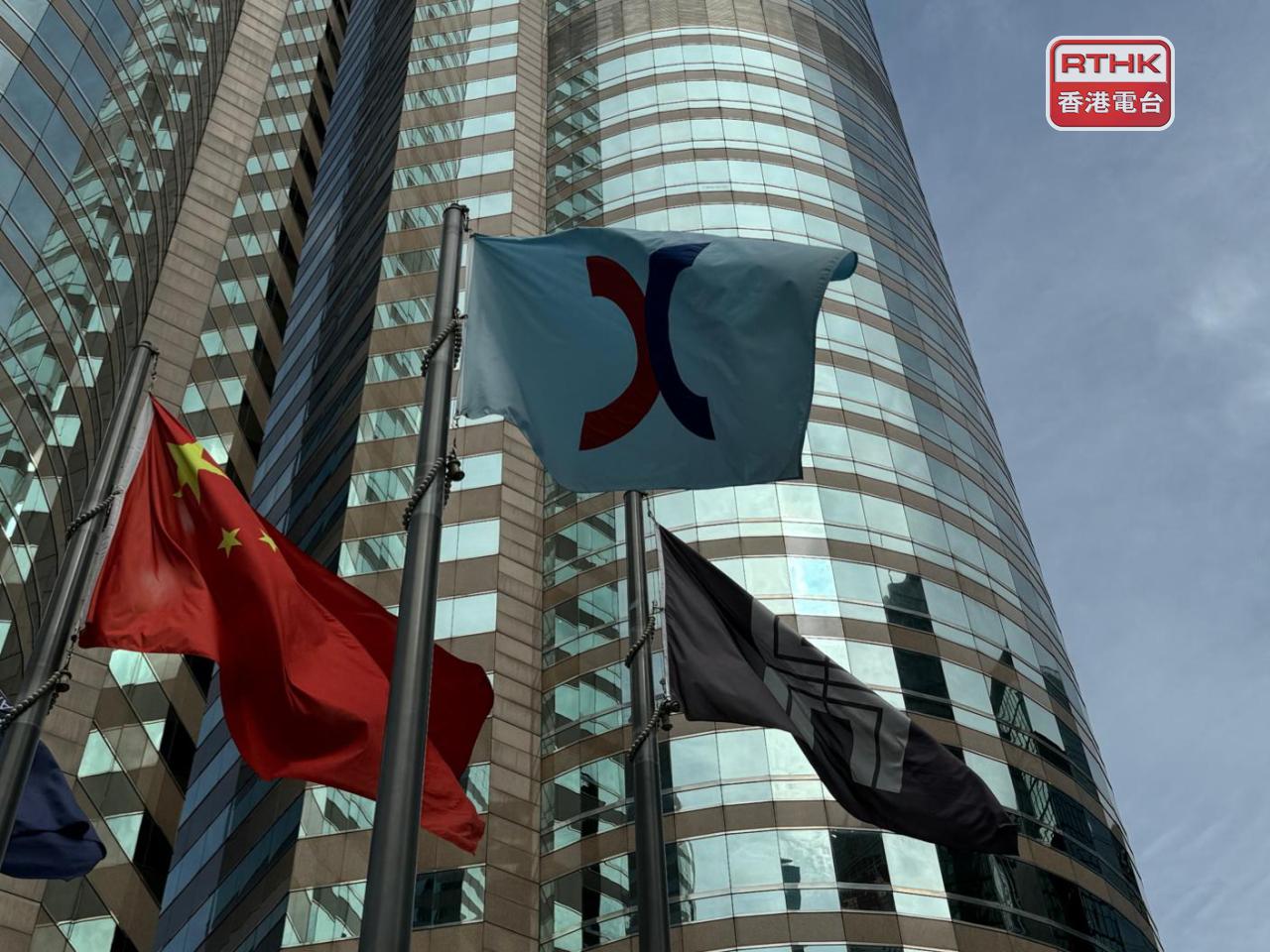

In Hong Kong, the benchmark Hang Seng Index ended up 150 points, or 0.56 percent, at 27,073 while the Hang Seng China Enterprises Index rose 0.63 percent to 9,599 and the Hang Seng Tech Index was 0.8 percent up at 5,981.

Alibaba rallied 3.3 percent after a Bloomberg News report that the firm is preparing a revamp of flagship AI app to resemble ChatGPT.

Up north, the benchmark Shanghai Composite Index was up 0.73 percent at 4,029, its highest since 2015, while the Shenzhen Component Index was 1.78 percent higher at 13,476 and the ChiNext Index, tracking China's Nasdaq-style board of growth enterprises, gained 2.55 percent to close at 3,201.

The combined turnover of these two indexes stood at over 2.04 trillion yuan, down from 1.95 trillion yuan on Wednesday.

Shares related to chemicals, ceramics and nonferrous metals led gains while those related to textile machinery and electric power suffered major losses.

China's blue-chip CSI300 index climbed 1.2 percent, with the CSI New Energy Vehicle Index leading gains by surging 6.2 percent to a three-year high and the New Energy Index rallying 4.7 percent in its biggest single-day gain in two weeks.

Battery maker CATL surged 7.6 percent to near a record high last seen in October while miner Tianqi Lithium jumped 10 percent.

The surges came as the Ministry of Industry and Information Technology is set to announce a comprehensive plan to boost the new energy battery sector and promote its infrastructure usage, a senior official said on Thursday.

The artificial intelligence sector and chip shares climbed 0.6 percent and 0.7 percent, respectively, to recover some losses seen this week.

"The market will likely continue consolidating and building momentum around the 4,000-point level in the short term, which is beneficial for solidifying the market foundation and accumulating strength for subsequent movements," analysts at Yingda Securities said in a note.

"It could help set the stage for further breaking new highs for the rest of the year."

Elsewhere, investors are awaiting China's key set of data releases such as retail sales, industrial output, and investment on Friday, to get a sense of the economic recovery and any implications for the policy outlook. (Reuters/Xinhua)