Mainland and Hong Kong stocks edged higher on Friday, snapping a three-day losing streak and reversing earlier losses in the week, as renewed optimism on domestic chipmakers boosted sentiment.

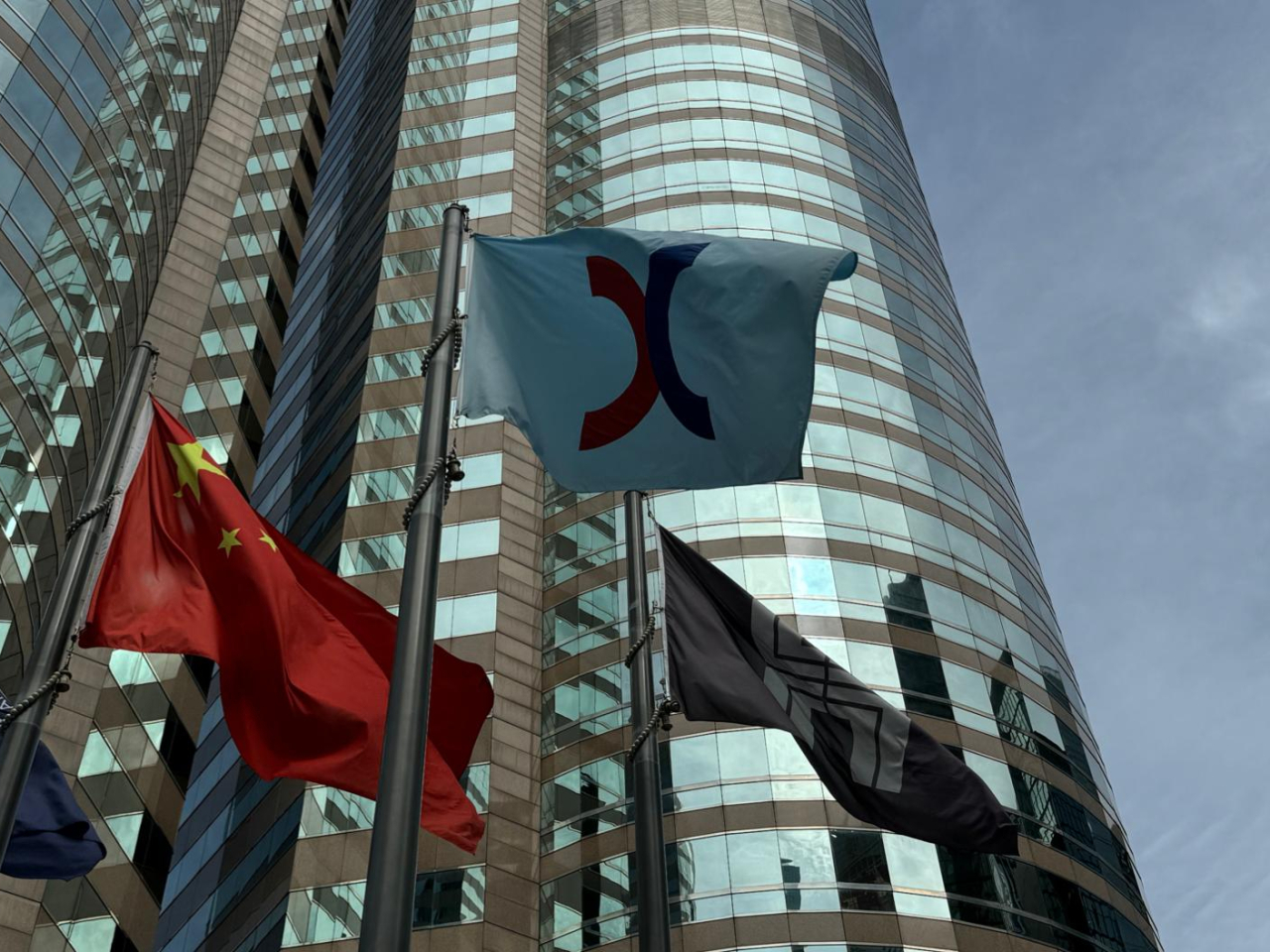

The benchmark Hang Seng Index ended up 149 points, or 0.58 percent, at 26,085 while the Hang Seng China Enterprises Index rose 91 points, or 1.01 percent, to 9,198 and the Hang Seng Tech Index rose 47 points, or 0.84 percent, to 5,662.

The benchmark Shanghai Composite Index was up 0.7 percent at 3,902 while the Shenzhen Component Index closed 1.08 percent higher at 13,147 and the ChiNext Index, tracking China's Nasdaq-style board of growth enterprises, rose 1.36 percent to 3,109.

The blue-chip CSI 300 Index added 0.8 percent and has gained 1.3 percent this week.

The combined turnover of the Shanghai and Shenzhen main indexes was 1.73 trillion yuan, up from 1.55 trillion yuan on Thursday.

Shares related to insurance, precious metals and commercial aerospace led gains while banking, traditional Chinese medicine and film/theatre stocks were among the biggest losers.

In focus on Friday, Moore Threads – often called "China's Nvidia" – surged roughly fivefold in its trading debut as investors bet the US-sanctioned firm will gain from Beijing's push to strengthen domestic chip production.

Its explosive debut followed news that a bipartisan group of US senators introduced a bill on Thursday aiming to prevent the Trump administration from easing restrictions on China's access to advanced AI chips from Nvidia and AMD for the next two-and-a-half years.

China's tech breakthroughs, as well as "national pride", amid geopolitical tensions, are set to continue being a main pillar for the slow bull market for the next six to 12 months, said Patrick Pan, China equity strategist at Daiwa Capital Markets in Hong Kong.

"From a longer-term perspective, we believe the recent pullback of China equities should have freed up more upside for the next year," he said in a note.

Also lifting the market on Friday was the insurance sector, which rallied 4.5 percent to the highest level since November 14, after the sector's regulator said it would lower the risk factor for insurers holding certain stocks, a move that could reduce capital requirements and free up more funds for investment.

The CSI 300 Real Estate Index was down 0.2 percent, continuing the recent slide. China's home prices are forecast to decline 3.7 percent this year, and are likely to fall through 2026 before stabilising in 2027, according to a latest survey. (Reuters/Xinhua)