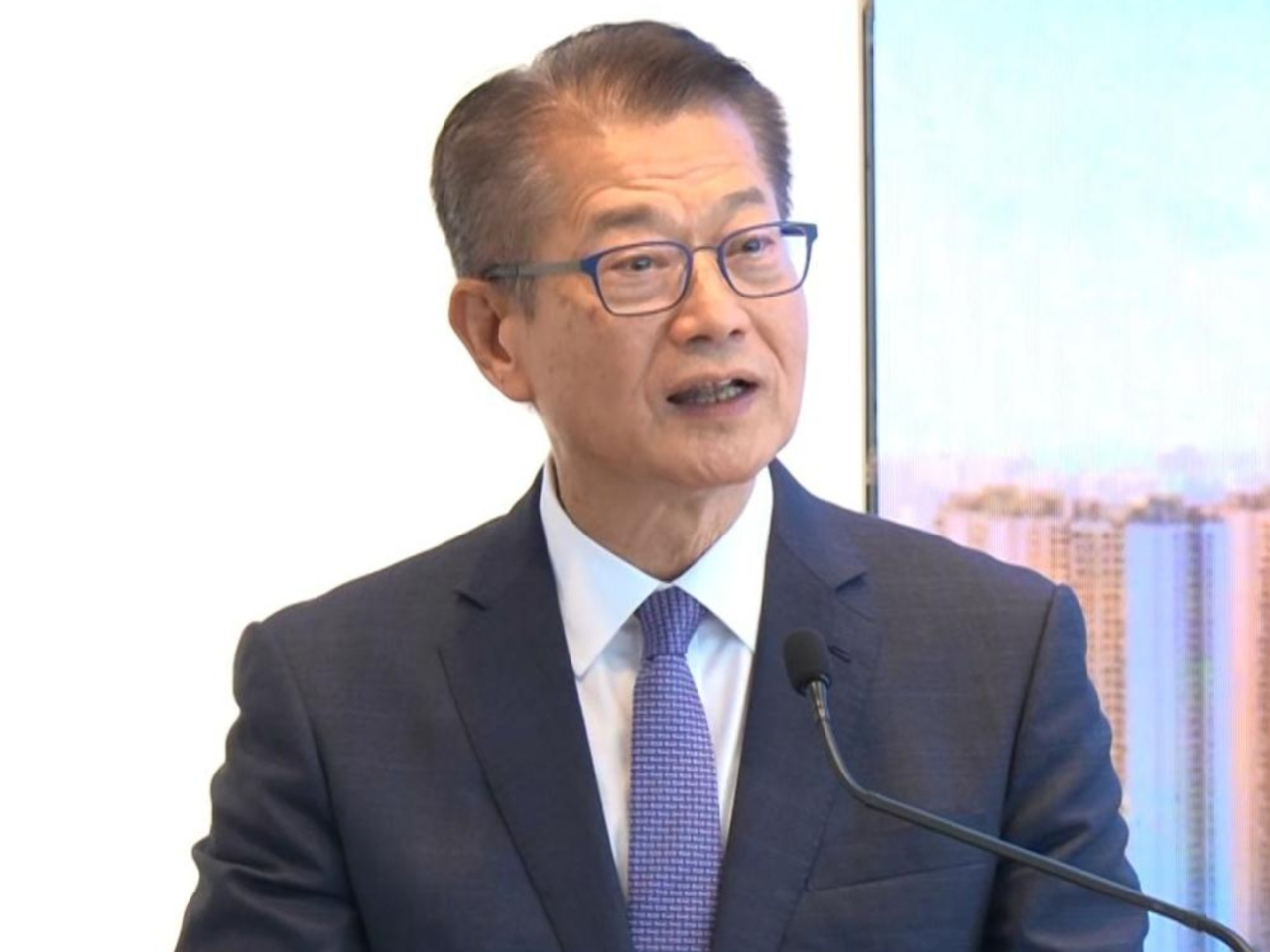

Hong Kong's economy is expected to move forward at a steady pace this year, Financial Secretary Paul Chan said.

Speaking in an interview with the Hong Kong Economic Times, Chan also said IPO fundraising in the SAR this year would "very likely" surpass the 2025 total of HK$285.8 billion as many companies prepare their listings here.

With the local economy projected to grow by 3.2 percent in 2025, the financial secretary said he believes it will post steady growth this year.

But he added that the benefits from a flourishing financial market will take time to filter through to the broader economy.

Detailed GDP growth forecasts will be released in his budget speech next month, Chan said.

Meanwhile, the minister said he's cautiously optimistic towards the IPO market this year.

He said enterprises that may prefer to be listed in the United States now face uncertainty because of geopolitical tensions.

"After they are listed, their operations may face greater uncertainty and pressure because of political reasons, so mainland enterprises would choose to be listed outside the US.

"Besides Hong Kong, I can't think of a better choice."

On the local property market, Chan said home prices are forecast to rise slowly and steadily, amid a cautious supply of land.

Although the US may not cut interest rates aggressively, he expects at least one or two additional rate cuts, which would help ease the mortgage burden on homeowners and have a positive impact on the residential market.

The financial secretary also said several leading companies were in talks with the government about setting up operations in the Northern Metropolis, and stressed the urgency of bringing in flagship firms together with their supply chains.

Chan pointed out that the government could offer concessions on land prices, as long as they came with clear contributions to job creation and the city's economy.