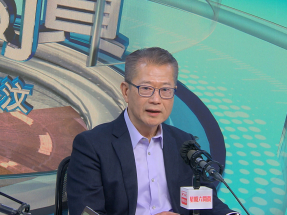

One of the world's largest accounting firms is calling for a significant tax relief boost in next month's budget that will benefit taxpayers across all income classes.

PwC is forecasting a consolidated deficit of HK$200 million for this fiscal year, a steep plunge from the government's original estimate that it will be in the red to the tune of HK$67 billion.

The firm attributed its deficit reduction forecast mainly to increased revenues from stamp duties, which it forecast would be around 48 percent higher compared to the government's original estimate.

Fiscal reserves stand at an estimated HK$654.1 billion, which is equal to approximately 10 months of government expenditure.

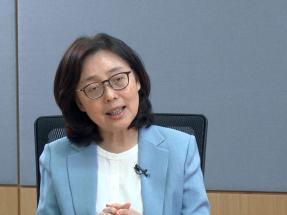

The firm’s South China private clients and family office tax leader, Agnes Wong, stressed that while the operating account was expected to return to a surplus, the government's capital account was likely to continue to face a deficit.

Revenue from land sales in the current fiscal year was projected to be HK$13 billion, 38 percent lower than the government's original estimate.

“The main reason for the capital-account deficit is because land premiums are not [as much as expected]. And then we still have to incur capital expenditure every single year,” Wong said.

“So it's very likely that the capital account itself – if there isn't a very significant improvement in the coming three to four financial years – will still be in deficit.”

PwC also put forward various recommendations for the budget, one of the key ones being to increase all allowances under salaries tax and personal assessment by at least 10 percent.

The firm is also proposing a 100 percent tax reduction in profits tax, salaries tax and tax under personal assessment for the current fiscal year, capped at HK$1,500 at least per case, meaning people pay nothing if their tax liability is below HK$1,500.

Also proposed is increasing the cap for tax deductions for rental payments and home loan interest from HK$100,000 to HK$160,000, as well as extending the maximum deduction period for mortgage interest from 20 to 25 years.

“Since the fiscal year of 2016, when we had an allowance adjustment for having children, there’s no other adjustment,” Wong said.

“So overall speaking, together with other suggestions, that's a more holistic approach. We believe that won’t have a big hit on the government’s overall financial status.”

There were also calls for tax incentives for yuan-denominated financial products, gold traders and investors in gold investment products.

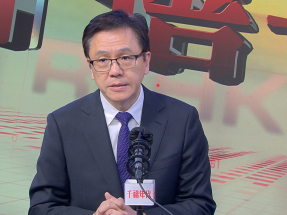

To attract more capital investment, PwC is proposing a tax deduction of 150 percent for enterprises investing in AI technologies, and a half-rate tax concession for companies with regional headquarters here undertaking activities of sufficient economic heft in the SAR.

The government has also been urged to continue to exercise strict discipline over recurring expenditure under the Reinforcing Fiscal Consolidation Programme, which was introduced in last year’s Budget and involved various “belt-tightening” measures such as size reduction for the civil service and a pay freeze.

When asked whether public workers should experience another round of pay freeze in the coming fiscal year, the firm said it believed the best approach to achieve sustainable operating surplus is through efficiency gains by implementing AI-related measures, not by cost-cutting.