Accounting giant Deloitte on Thursday called on the government to reduce taxes when it unveils the next Budget in late-February.

It is forecasting a HK$500 million consolidated surplus for this current fiscal year, up from the financial secretary's prediction of a HK$67 billion deficit last February, due to increased stamp duty revenue from stocks and other investment returns.

Fiscal reserves are expected to stand at around HK$654.8 billion — about 10 months of government expenditure.

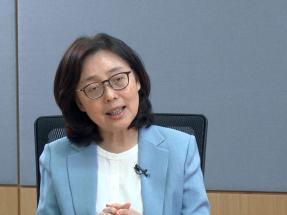

“We believe it is acceptable because even though we project a break-even position this year... the government needed to incur quite a lot of capital spending, which should not affect the recurring expenditure of the government. We believe that the fiscal surplus is still in a healthy position,” said Polly Wan, who leads Deloitte’s budget team in the SAR.

The firm suggested a 100 percent cut in salaries tax and tax under personal assessment with a cap of HK$5,000 per case for this fiscal year.

It also urged raising the personal tax allowance by 10 percent in the 2026-27 fiscal year to HK$145,200, as the current allowance of HK$132,000 has remained unchanged for the previous 10 years.

"Based on our estimation, the tax relief of HK$5,000 will affect the government revenue by HK$1 billion, and the increase in basic allowance would affect the revenue by HK$0.7 billion. So the overall impact is less than HK$2 billion,” Wan said.

"Given the estimated consolidated surplus this year, we believe the fiscal position of Hong Kong is sufficient to give these sweeteners to the taxpayers," she added.

In the wake of the Tai Po fire last November, the firm also called on the government to consider a one-off tax reduction of no more than 10 percent of chargeable income for those who are affected by incidents that are defined as "disasters", as a way to provide more well-rounded support.

It also urged the government to consider introducing a stamp duty adjustment mechanism to attract more foreign enterprises to list on the local stock market, and to roll out tax and investment incentives for companies that set up shop in the Northern Metropolis.