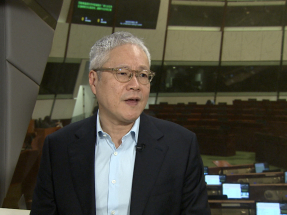

While the government has returned to a surplus in its operating account, authorities have to continue to ensure cash flow remains strong to meet long-term development needs, Financial Secretary Paul Chan said on Saturday.

In the first nine months of the current fiscal year, Hong Kong recorded a surplus of HK$43.9 billion.

Speaking on a radio programme, Chan attributed this year’s fiscal position to a robust export performance. He also pointed to an active financial market, which boosted stamp duty revenue.

He projected that the operating account would end the year in surplus territory. However, he said the government was planning to issue bonds to cover a shortfall in the capital account.

"Let’s not forget that we also need to accelerate the development of the Northern Metropolis, and various infrastructure projects must be expedited," Chan said.

"Therefore, in the capital account, we will need to issue bonds for support.

"When looking at the consolidated accounts, besides government revenue, funds obtained from bond issuance will also be included as part of the income when compiled on a cash flow basis."

Overall, Chan said, a return to fiscal balance is expected to happen earlier than previously forecast.

The financial secretary acknowledged that different sectors of society had their own demands. He emphasised the need to balance current needs with essential long-term investments.

"We need to have a buffer due to the current complexities in geopolitical situations, with funds flowing in and out, and various speculators potentially impacting us," Chan said.

"We must retain sufficient reserves to withstand such attacks."

Looking ahead, Chan expressed cautious optimism about Hong Kong’s economic prospects this year, pointing to stable national development and steady economic growth.