An accounting giant on Wednesday called on the government to roll out higher tax allowances in its budget to be revealed this month, to better support residents and boost the SAR’s competitiveness globally.

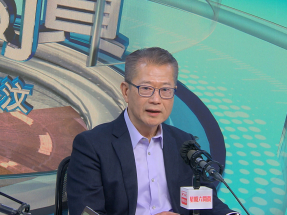

KPMG is forecasting a HK$11.2 billion deficit in the current fiscal year, far lower than the government’s earlier estimate of around HK$67 billion, due to better than expected stamp duty revenue.

It said the administration may be able to achieve a consolidated surplus earlier than the 2028/29 fiscal year as expected, depending on the pace of development for the Northern Metropolis.

The firm urged the government to raise the basic personal tax allowance to HK$140,000 and make yearly adjustments based on inflation, nothing that the current allowance of HK$132,000 has been in place for a decade.

The firm suggested the administration provide an additional tax allowance of HK$60,000 for working families with domestic helpers or grandparents who care for children under 16 or disabled people, and extend dependent allowances to cover parents and grandparents residing in the Greater Bay Area.

It also said a 100 percent tax rebate capped at HK$6,000 for profits tax, salaries tax and tax under personal assessment should be provided to relieve the burden on residents.

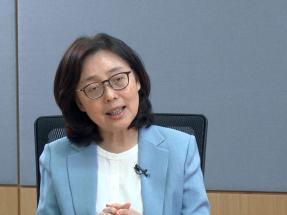

“The HK$6,000 suggestion is made in view of the improved fiscal position. It is referenced from the situation in 2022-23, in which the government also had a similar deficit,” said the firm’s tax partner Stanley Ho.

“In terms of impact to the fiscal position, it will be around HK$10 billion, which is affordable. The [tax relief] also provides a chance to give back to general public society in view of the improved position.”

To boost the city’s business prospects, the firm suggested tax incentives be put in place to attract multinational corporations to establish regional headquarters in Hong Kong, as well as enhancing the existing taxation mechanism to encourage more family offices to set up shop in the city.

As for Northern Metropolis development, it said "super tax deductions" should be given for research and development conducted in the location and elsewhere in the Greater Bay Area, to encourage cross-border innovation and support the development of future industries.