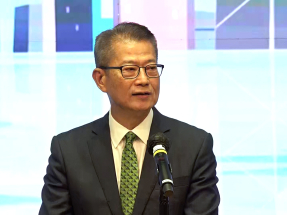

The chief executive of Hong Kong Monetary Authority (HKMA), Eddie Yue, on Thursday said lowering the city's borrowing costs would boost the city's economy, but he also cautioned of uncertainties ahead.

His remarks came as the city's de facto central bank reduced its base interest rate to 4.5 percent, hours after the US Federal Reserve cut its target rate by 25 basis points to a range of between four to 4.25 percent overnight -- following a weakening labour market.

Hong Kong's monetary policy moves in lock-step with the United States as the city's currency is pegged to the greenback in a tight range of 7.75-7.85 per dollar.

The new base rate is the lowest in the city since December 2022.

"Of course, if the interest rate is lowered, then it can alleviate the debt burden on some individuals or enterprises to a certain extent, and it will also have a certain positive impact on the city's economy and the real estate market," Yue told reporters.

"[But] the economy and the property market will also be affected by other factors, and we have also observed that Hong Kong's economy has been gradually improving this year.

"I believe all these factors will support the economic development of Hong Kong," he said, adding the SAR's financial and monetary markets continue to operate in a smooth and orderly manner.

Looking ahead, he noted that while the Fed is expected to further reduce interest rates by 50 basis points before the end of the year, the extent and pace of the future US interest rate cuts "are still uncertain", subject to the development of the US labour market, inflation, and tariff effects.

He urged individuals who wish to take loans to carefully assess any potential risks.

Separately, Yue noted the SAR would encourage more banks, especially lenders from the mainland, to set up regional headquarters here - after Chief Executive John Lee announced such measures in his Policy Address on Wednesday, as part of the efforts to assist the banking sector to further expand overseas.

"In fact, many international banks and mainland banks have already adopted Hong Kong as their Asian headquarters. However, we can see that there is still room to further promote this so they can make Hong Kong their central platform in Asia," he said.

"We have also seen a growing number of enterprises, be it from the mainland or Hong Kong, going global, especially to explore markets in other regions in Asia, including Asean, which will offer us new opportunities."

In his Policy Address, Lee also said the SAR would invite the Asian Infrastructure Investment Bank (AIIB) to set up an office in Hong Kong.

The Beijing-headquartered multilateral development bank is seen as China's alternative to the World Bank.

- Home

2025-10-26 HKT 11:46

2025-10-22 HKT 19:05

2025-10-18 HKT 15:09

2025-10-10 HKT 19:02

2025-10-08 HKT 12:57

2025-10-06 HKT 21:04

2025-10-06 HKT 17:03

2025-09-29 HKT 16:50

2025-09-29 HKT 12:33

2025-09-29 HKT 10:04

2025-09-28 HKT 15:34

2025-09-28 HKT 13:30

2025-09-27 HKT 12:56

2025-09-27 HKT 12:04

2025-09-22 HKT 13:46

2025-09-22 HKT 12:52